What You Need to Know about Medicare Supplement Plans

What is Medicare supplemental insurance?

Medicare Supplement Insurance Plans (or Medigap plans) are private senior health insurance policies designed to fill the gaps in medical coverage left by Medicare Part A and Medicare Part B.

What is covered by Medicare supplemental insurance?

Medigap insurance policies cover medical procedures approved by Medicare. Some policies go further and offer limited benefits relating to certain expenses not covered by Medicare.

Who is eligible for Medicare supplemental insurance?

Anyone covered under both Medicare Part A and Medicare Part B is eligible to enroll in a Medigap plan. Although companies reserve the right to set further qualification criteria beyond Medicare eligibility at their own discretion, they cannot exclude anyone in a Medicare open enrollment period or Medicare Guaranteed Issue period.

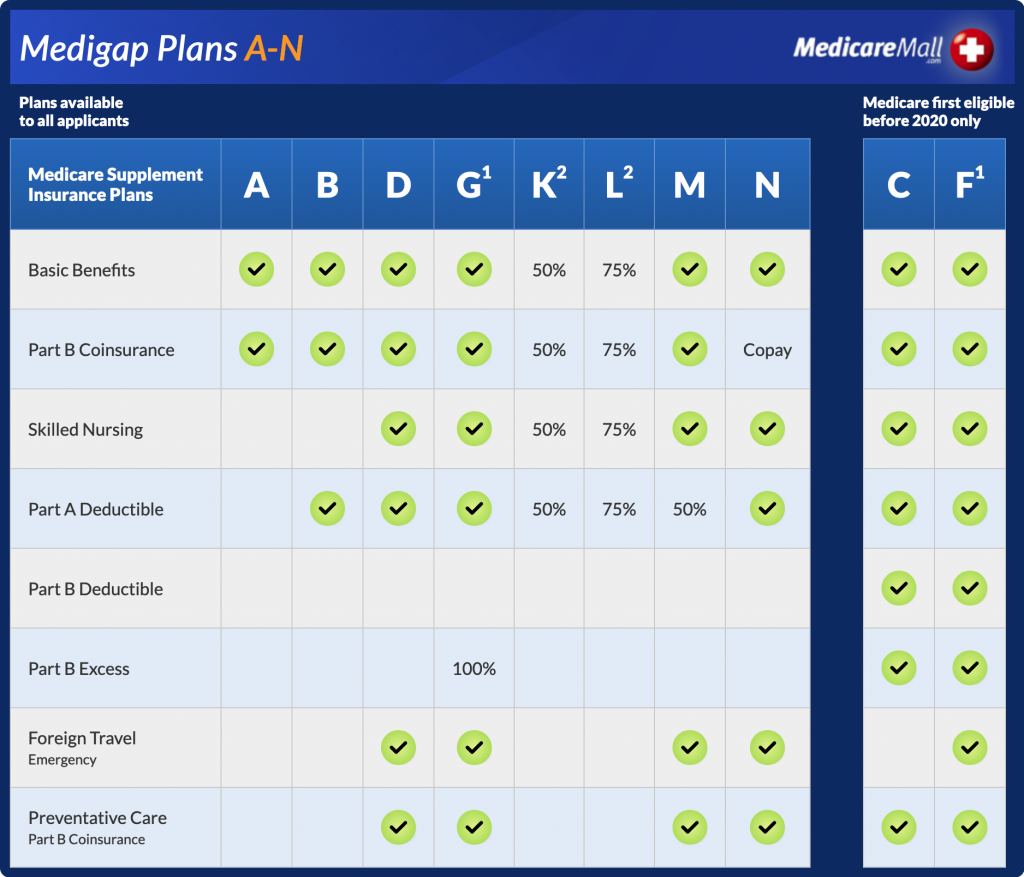

What plans are available?

Most states only allow standardized Medicare supplement insurance plans. Any Medigap insurance company offering supplement insurance coverage is required to offer Medicare Plan A (Medicare’s base plan). Any other combination of Medigap supplemental plans (from B-N) may be available at the company’s discretion.

Are there any differences between the same Medigap plans offered by different companies?

Same-policy coverage by different companies for doctor and hospital visits is the same. For instance, a Medigap Plan F policy offered by one Medigap insurance company will pay the same as a Medigap Plan F offered by another company.

What about pre-existing conditions?

Medicare supplement insurance companies may exercise a pre-existing conditions clause limiting their liability for up to six months after the issue date of the policy. Some companies will not exercise this option, however, and all companies must waive this limitation for the period in which you had previous creditable coverage.

How do prices vary?

Medicare supplement insurance prices vary from company to company and from plan to plan. There is no standardization of pricing for Medigap supplement plans or premiums. Therefore, you could pay substantially more for the exact same Medigap coverage offered by another company at a lower price.

Can I keep the same doctor I’ve been seeing for years?

Medicare supplement insurance plans do not place limits on the doctors or hospitals you can choose. There are no networks. You simply choose any provider that accepts Medicare, and your Medicare supplement plan will pay that provider as stated in your policy.

Is it hard to file claims?

Not at all. Medicare supplement insurance plans use a very easy and mostly automated claims process. For Medicare Part B claims, for example, each Medicare supplement insurance company is linked directly to Medicare, and there is rarely a need for you or your doctor to file a claim for outpatient services.

What’s the bottom line?

Medicare supplement insurance plans can provide you the comfort of knowing you will not be burdened by the Medicare gaps left by Medicare Part A and Medicare Part B. However, it’s important to compare Medigap plans and rates to make sure you find the policy that’s best for you. MedicareMall is the expert at shopping the market on your behalf, and we’re ready to find the Medicare supplement plan will work for you.

Contact us now and we’ll guide you through the Medicare maze to the place you want to be.

Medicare Supplement Index | Medigap Policy Providers Index