Medigap Plans A-N

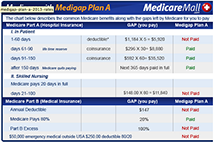

Plan A, by law, is in the selection of plans offered by every company selling Medicare supplement plans. Although Plan A is readily available, however, it provides the lowest level of benefits of any Medicare supplemental insurance plan on the market.

Plan A, by law, is in the selection of plans offered by every company selling Medicare supplement plans. Although Plan A is readily available, however, it provides the lowest level of benefits of any Medicare supplemental insurance plan on the market.

Unfortunately, this means Plan A won’t fill many of the gaps left by Medicare. This is reflected in the cost of the plan. While the premiums may be extremely affordable, the long-term financial consequences can be serious should you find yourself in need of certain hospital and medical services.

A 68-year-old male living in the Dallas-Fort Worth area will pay from $99.63 to $223 per month for Plan A coverage, depending on the company he chooses. That’s a difference of $123.37 per month—or nearly $1,500 per year—from one company to another, and as compelling an argument as you’re likely to find in favor of comparison shopping with MedicareMall.

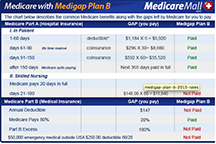

Plan B offers basic benefits, but doesn’t cover skilled nursing care, Medicare Part B medical deductibles, Medicare Part B excess, or medical costs incurred during foreign travel. Overall, Plan B falls short of filling many of the gaps in Medicare coverage. As is the case with Medicare Supplement Plan A, this is reflected in the cost of the plan. While the premiums are low, you can quickly run up some substantial bills if you find yourself in need of certain hospital and medical services.

Plan B offers basic benefits, but doesn’t cover skilled nursing care, Medicare Part B medical deductibles, Medicare Part B excess, or medical costs incurred during foreign travel. Overall, Plan B falls short of filling many of the gaps in Medicare coverage. As is the case with Medicare Supplement Plan A, this is reflected in the cost of the plan. While the premiums are low, you can quickly run up some substantial bills if you find yourself in need of certain hospital and medical services.

Medicare Part B excess refers to costs providers charge above the Medicare-approved amount. For example, if the Medicare-approved charge for a treatment or procedure is $1,000 but your health provider charges $1,500, the 80% Medicare reimbursement will apply only to the Medicare-approved charge, in this case $1,000. You will be responsible for the remaining $500 excess.

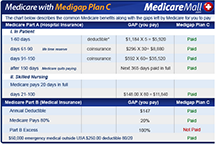

Plan C offers the basic services standardized by Medicare along with a few other benefits that aren’t covered by Medicare Supplement Plan A or Plan B. Plan C, for example, pays both Medicare Part A and Medicare Part B deductibles. Yet Plan C falls short of filling many of the gaps left by Medicare, leaving seniors in danger of facing high out-of-pocket costs if they require hospital and medical services that aren’t covered.

Plan C offers the basic services standardized by Medicare along with a few other benefits that aren’t covered by Medicare Supplement Plan A or Plan B. Plan C, for example, pays both Medicare Part A and Medicare Part B deductibles. Yet Plan C falls short of filling many of the gaps left by Medicare, leaving seniors in danger of facing high out-of-pocket costs if they require hospital and medical services that aren’t covered.

Because Plan C offers more comprehensive protection, its premiums are higher than those of Plan A or Plan B. A 66-year-old female nonsmoker living in Tulsa, Oklahoma, will be charged rates from $115.51 to $129.76 per month, depending on the company she chooses.

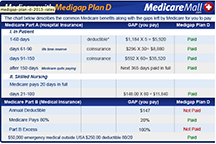

Plan D, designed to cover most of the high-risk gaps in Original Medicare, has long been an affordable option in select markets. Plan D, however, doesn’t cover Medicare Part B excess. This leaves the Plan D enrollee responsible for medical bills exceeding the amount approved by Medicare.

Plan D, designed to cover most of the high-risk gaps in Original Medicare, has long been an affordable option in select markets. Plan D, however, doesn’t cover Medicare Part B excess. This leaves the Plan D enrollee responsible for medical bills exceeding the amount approved by Medicare.

That same 66-year-old female nonsmoker in Tulsa would pay between $92.94 and $111.32 to enroll in Medicare Supplement Plan D.

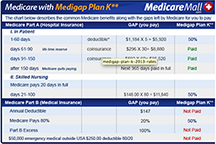

Plan K offers coverage for a wide variety of services, and may be a good choice if you prefer lower premiums, have low medical expenses, and are willing to share in the cost of medical services throughout the year. While requiring you to pay a percentage of certain covered charges including copayments, coinsurance, and deductibles, Plan K begins paying 100% for all Medicare-covered services once out-of-pocket expenses reach the yearly cap of $4,460. However, excess charges aren’t covered and don’t count toward the out-of-pocket limit..

Plan K offers coverage for a wide variety of services, and may be a good choice if you prefer lower premiums, have low medical expenses, and are willing to share in the cost of medical services throughout the year. While requiring you to pay a percentage of certain covered charges including copayments, coinsurance, and deductibles, Plan K begins paying 100% for all Medicare-covered services once out-of-pocket expenses reach the yearly cap of $4,460. However, excess charges aren’t covered and don’t count toward the out-of-pocket limit..

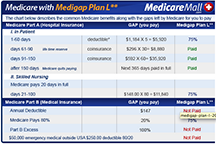

Plan L is similar to Plan K, but the Plan L out-of-pocket limit is set at $2,300. Like Plan K, Plan L has a relatively low monthly premium. While Plan L and Plan K both cover your Medicare Part A coinsurance before you reach the out-of-pocket limit, Plan L pays 75% of your coinsurance costs for most other Medicare-covered services while Plan K chips in at a lower 50%.

Plan L is similar to Plan K, but the Plan L out-of-pocket limit is set at $2,300. Like Plan K, Plan L has a relatively low monthly premium. While Plan L and Plan K both cover your Medicare Part A coinsurance before you reach the out-of-pocket limit, Plan L pays 75% of your coinsurance costs for most other Medicare-covered services while Plan K chips in at a lower 50%.

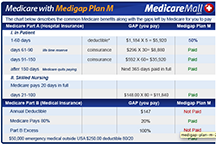

Plan M offers increased cost sharing and includes many benefits similar to those offered through other options such as Plan D. Plan M, however, covers only 50% of the Medicare Part A deducible and none of the Medicare Part B deductible. Plan M is priced approximately 10% lower than Plan D.

Plan M offers increased cost sharing and includes many benefits similar to those offered through other options such as Plan D. Plan M, however, covers only 50% of the Medicare Part A deducible and none of the Medicare Part B deductible. Plan M is priced approximately 10% lower than Plan D.

MedicareMall.com’s most popular Medicare supplement plans—and the Medigap plans offering the best protection for your dollar—are Plans F, G, and N.

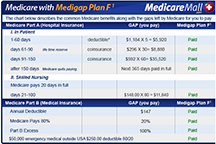

Plan F, widely considered the benchmark for Medicare supplement insurance plans, is designed to cover all the high-risk gaps left by Original Medicare. Plan F has proven to be a great tool for those who want to budget their annual healthcare cost. This plan’s comprehensive coverage is designed to leave you with no out-of-pocket expense for Medicare-approved services. Considering the great budgeting opportunity it provides, it’s no surprise that Plan F is such a popular Medicare supplement insurance plan.

Plan F, widely considered the benchmark for Medicare supplement insurance plans, is designed to cover all the high-risk gaps left by Original Medicare. Plan F has proven to be a great tool for those who want to budget their annual healthcare cost. This plan’s comprehensive coverage is designed to leave you with no out-of-pocket expense for Medicare-approved services. Considering the great budgeting opportunity it provides, it’s no surprise that Plan F is such a popular Medicare supplement insurance plan.

A 67-year-old male nonsmoker in Tulsa can pay as little as $126.16 a month for Plan F coverage, while a 66-year-old female nonsmoker in Tulsa can pay as little as $117.41.

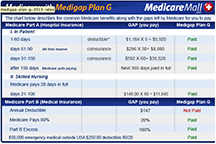

Plan G has proven to be an excellent alternative to Plan F. Plan G’s benefits nearly match those of Plan F, with the only difference being that Plan G doesn’t pay the Medicare Part B deductible. Plan G premiums are often about 20% lower than premiums for Plan F.

Plan G has proven to be an excellent alternative to Plan F. Plan G’s benefits nearly match those of Plan F, with the only difference being that Plan G doesn’t pay the Medicare Part B deductible. Plan G premiums are often about 20% lower than premiums for Plan F.

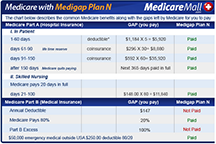

Plan N covers your Medicare Part A deductible in full but does not cover the Medicare Part B deductible.

Plan N covers your Medicare Part A deductible in full but does not cover the Medicare Part B deductible.

Rather than paying the traditional Medicare Part B coinsurance, under Plan N you’ll have copayments for doctor visits and trips to the emergency room.

In many states Plan N has no medical underwriting. If this is the case in your state, you won’t be required to answer any questions about your medical or prescription history when you apply. A few states have limited underwriting for this plan. Call toll-free (877) 413- 1556 and our representatives will be glad to provide information specific to your state.

Medigap Plan N typically costs about 30% less than Plan F. Also working in Plan N’s favor are its low out-of-pocket costs and absence of network restrictions.

A 68-year-old nonsmoking male in Dallas-Fort Worth can get Plan N coverage for as little as $91.80 a month, while a 66-year-old nonsmoking female in Tulsa can pay as little as $79.