Five Common Questions about Medigap Plans

The new year is here. For some of you that means staying on top of life’s responsibilities like your senior health insurance plan. If this includes enrolling in a Medicare Supplement Insurance Plan, listen up, here are some tips to help you keep that resolution.

The new year is here. For some of you that means staying on top of life’s responsibilities like your senior health insurance plan. If this includes enrolling in a Medicare Supplement Insurance Plan, listen up, here are some tips to help you keep that resolution.

When people began shopping around for a Medigap Plan, they tend to ask the same basic set of questions. In today’s post we will provide you with the answers to some of those common questions about Medicare Supplement Insurance.

- How does Medicare Supplement Coverage work? Medicare Supplement Insurance essentially picks up where Original Medicare leaves off.

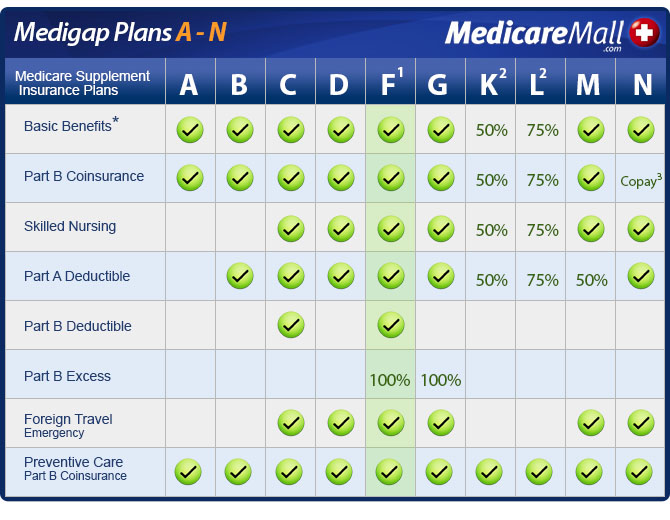

With a Medigap Plan, you get all of the same perks of Medicare Part A and Medicare Part B plus you’ll get additional coverage on top of that. Let’s say under some circumstance you end up needing to be hospitalized. Medicare Part A coverage will be extended to you after you hand over payment for your deductible ($1,156 in 2012). A Medigap Plan would cover all or some of this deductible. - What is the difference between different Medigap Plans? Different Medigap Plans offer different coverage options. Medigap Plan F is the most comprehensive of the Medicare Supplement Plans. For a better understanding of the differences, visit our Medigap Plans Overview page or take a look at this chart:

- Do Medigap Plans vary by state? Often times people will ask something like, “I have a Medigap Plan G and I currently live in Texas, but I’m moving to Louisiana…will my coverage be the same?” The answer is most certainly, yes! The beauty of Medicare Supplement Plans is that although they are distributed through private insurance carriers, they are standardized by the federal government. As far as coverage goes, a Plan G in Texas will offer the same coverage as a Plan G in Louisiana.

- If Medigap Plans are standardized, why do some companies charge more than others? We find that sometimes our clients are hesitant to go with lesser-known carriers for their Medicare Supplement Insurance even if those carriers offer a lower rate. These lesser-known carriers will sometimes have more strict underwriting criteria than a big company like United Health Care for example, and can thus charge less for having such a strict set of enrollment policies. For a better explanation of the underwriting process, fill out our free Medigap quote form to get into contact with a Medicare Supplement agent who can explain personally explain how these health questions apply to your medical history.

- Will my doctor accept my Medigap Plan? The best way to answer this question is to find out if your current physician accepts Medicare. If he/she indeed does, your Medicare Supplement Insurance plan will undoubtedly be accepted there.

Do you have more questions? Please visit our contact form or submit your information in the zip code box below to receive Medicare Supplement Insurance information from MedicareMall.

New Plan, New Year © 2012 MedicareMall.com