Last week, we made a post about the Medicare Part B Premium changing. This week we’d like to go further in depth about these changes and talk about how they affect Medicare beneficiaries.

Last week, we made a post about the Medicare Part B Premium changing. This week we’d like to go further in depth about these changes and talk about how they affect Medicare beneficiaries.

Let’s break it down into the different parts of Medicare:

Medicare Part A

What changed: Medicare Part A Premiums will increase $1 per month and Medicare Part A deductible will increase by $24.

Who will it affect: Only 1% of Medicare Beneficiaries pay a Medicare Part A premium. The Medicare Part A deductible increase will be paid by any Medicare beneficiary requiring hospitalization, unless they have a Medicare Supplement Insurance Plan that covers those charges. The Medicare Part A deductible is fully covered under Medigap Plans B, C, F, G, and N.

Medicare Part B Premium

What changed: The 2011 Medicare Part B premium was $115.40, so the 2012 $99.90 premium price would be a $15.50 decrease. Monthly social security payments to enrollees will increase by 3.6%.

The Medicare Part B 2012 deductible will be $22 lower at $140. This deductible is covered under Medigap Plan F and Medigap Plan C.

Who will it affect: Seniors enrolled in Medicare Part B during 2011 paid a monthly premium of $115.40 for physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and other items and receive more from their monthly benefit social security check. Most beneficiaries, however, were exempt from this price and paid $96.40, the new price for them was a $3.50 increase. This increase is offset by the increase in their social security benefit check.

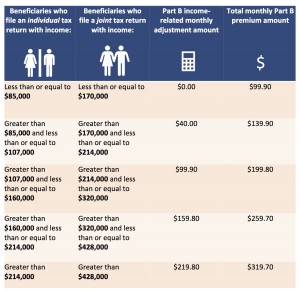

The amount you pay for Medicare Part B will also depend on your annual income. These adjustments are called income-related Medicare Part B premiums. For example, if you and your spouse make a combined total of $190,000 per year, your total Medicare Part B premium will cost you 199.80 per month. See the following table to see where you fall.

Medicare Part B income adjusted premiums:

Source: Centers for Medicare and Medicaid Services (CMS)

To get more information about Medicare Supplement Insurance plans, talk to one of our Medigap plan representatives today or use our instant quote below.

Medicare Premiums and Deductibles for 2012 © MedicareMall.com

I have heard that Obama has already taken…………… $550 BILLION……….from Medicare….and that must be the reason so many Dr’s have stopped seeing patients on Medicare….No one seems to be talking about this….All I ever hear is how Medicare and Social Security are broken…..No one ever talks about the real reason Social Security is broke….The Congress has been stealing that money since the early 80’s….Why would the youngsters want to participate in a program that steals what they put in…Just think …If all our contributions had not been stolen all these years, and had instead gained interest, just think…SS would not be broke….You never hear anyone talk about paying us back, do you?….As for Medicare, …do please let me know when Obama raided it….Beats me why they haven’t gone after the fraud they found…I guess it was alot easier to take from the Seniors….to pay for his unpopular Healthcare Plan…Waiting to lear back please…

Barbara,

I am 65 and I can tell you with certainty that it started under LBJ when he transferred to money into the General Fund. At that time, he said no problem, we will put it back as needed….LOL….None has ever been returned……Politicians are thieves !!!!!

Hi Barbara, thanks for sharing your comment.

It has been reported that as much as 40 percent of doctors, physicians, and hospitals are limiting acceptance of new Medicare patients in some states because Medicare reimbursements were cut by as much as 21% in 2008. A large percentage of those reimbursements come from Medicaid. Presently, 97% of doctors still accept Medicare assignment (or payment), but can only accept a certain number of new Medicare patients. This should not affect current patients. This does not mean they do not accept Medicare. There are still plenty of doctors, clinics, and hospitals that take new Medicare patients.

Use the following link to find a Medicare provider near you:

http://www.medicare.gov/find-a-doctor/provider-search.aspx

Barbara – Technically, the US General Fund has “borrowed” the “Trust Fund” & replaced the $ with US Treasury Bonds, which have never been retired but simply rolled over to new current bonds at maturity. They do “pay” interest at the US Treasury rates. Current Social Security Payments are made from Social Security taxes being paid in by current employees. The debt owed to the Trust Fund now greatly exceeds the ability of the General Fund to repay: thus the bankrupt problem. I too am dismayed at the lack of Congress willingness to tackle this massive debt problem – along with the rest of their spending in excess. Let’s get back to a Federal Government limited to its Constitutional Authority!

Wendell

I was paying $115.40 for my medicare Part B plan per month. The December 25,2011 payment shot up to $319.70 per month. I called Medicare and found out that Social Security had turned in my 2010 income and the premium was based on that. I asked how often SS reviewed the yearly income. I was told to call Social Security. I did call SS and got the run around on the menu. If my question didn’t fit the menu then I was just given the same selections again. Peggy never answered no matter what I did.

I was fortunate enough to get lease money on my property in 2010. The IRS took half of it, leaving me approximately half. So my income went up. However I will not get lease money every year, because that lease was for 5 years; and then again I may never get to lease that property again. So am I stuck with this payment for the rest of my life. Does anyone out there know? Does anyone know what I should do? I am 83 years old and what little extra money I got with that lease will disappear quickly for medication.

Mary — No, you aren’t stuck with that payment the rest of your life… only for that year. Go to the following link http://www.socialsecurity.gov/pubs/10536.html, then scroll down to Modified Adjusted Gross Income (MAGI) and it has a chart that shows different income levels. The monthly premium you are currently paying will be for ONE year… meaning any change in income changes your premium for one year at a time. If the following year your income goes down your premium will be adjusted to the new level. If your income increases again your premium will increase again. In other words your premium changes each time your income changes and each change lasts ONE year.

Mary – Sorry, I missed a step. Go to the link http://www.socialsecurity.gov/pubs/10536.html and then click on ‘Monthly Medicare Premiums for 2012’ and it will open to the MAGI chart.

What is the projected premium in 2014?.

I asked if you could tell me what the projected premium will be 2014?.

Hi Theodore,

Thank you for your question. We do not have access to that information, nor do we have control of setting Medicare premiums and deductibles. Once the Center for Medicare and Medicaid Services (CMS) releases the official numbers, we will post the most up to date information on our website.