Medicare, as you may be aware, is administered at a cost of over half a trillion dollars annually. That’s a lot of money, and you may wonder where it comes from.

Medicare, as you may be aware, is administered at a cost of over half a trillion dollars annually. That’s a lot of money, and you may wonder where it comes from.

The Cost of Medicare

To be precise, Medicare.gov reports that Medicare expenditures in 2011 totaled $549 billion. With 48.7 million Americans enrolled in Medicare in 2011, that comes out to about $11,300 per Medicare recipient. In 2012, meanwhile, Medicare rolls increased to 50.7 million, a whopping 4 percent increase from the previous year, while spending per capita stayed at around $11,300 for the year, resulting in additional expenditures of $25 billion in 2012 over the previous year.

Projected growth of the Medicare population over the next decade ensures Medicare spending will continue to rise in coming years.

Medicare Funding

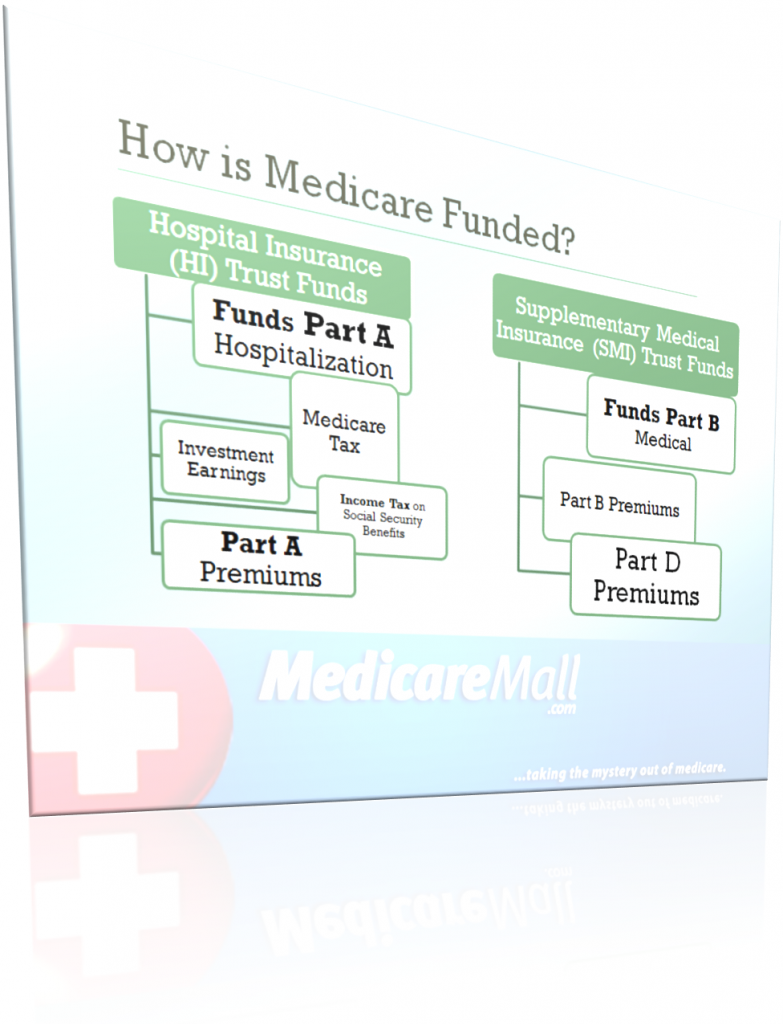

Medicare funding comes from two United States Treasury trust fund accounts established by the Social Security Act and devoted entirely to funding Medicare.

Get your free Medicare Supplement quote today.

The Medicare Trust Funds:

- The Hospital Insurance (HI) Trust Fund pays for Medicare Part A benefits and some Medicare administration costs.

HI—hospital insurance—refers to Medicare Part A, which, in short, pays for inpatient hospital services, skilled nursing facility care after a hospital stay, home health care, and hospice care.

The HI Trust Fund is funded by:

- The Medicare tax

- Trust fund investment earnings

These areas of funding are straightforward. Any American with a work history during the past several decades is well aware of the Medicare tax. Currently, the tax is set at 2.9 percent for self-employed persons, and 1.45 for wage earners, whose employers chip in at the same rate. Since the start of this year, people earning $200,000 or more annually are required to pay an additional 0.9 percent on top of the basic Medicare tax, with wage earners responsible for the full additional amount.

Fund investment earnings have normally been sufficient to ensure Medicare income exceeds expenditures. Medicare has operated at a surplus most years since it was established in 1965.

The Hospital Insurance Trust Fund is also supported by:

- Income taxes on Social Security benefits

- Medicare Part A premiums

These are limited sources of funding, however. Social Security benefits are not normally taxed unless, as SocialSecurity.gov explains, “you have other substantial income (such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return) in addition to your benefits.”

Similarly, many people are exempt from paying Medicare Part A premiums. In fact, few are not exempt. About 99 percent of Medicare recipients qualify for premium-free Part A coverage because they or a close relative already paid the cost of coverage during their working years.

- The Supplementary Medical Insurance (SMI) Trust Fund pays for Medicare Part B benefits. It also pays costs associated with Medicare Part D and, like the HI Fund, pays some costs of administering Medicare.

SMI refers to Medicare Part B and Medicare Part D. Part B helps pay for medical expenses, clinical laboratory services, and outpatient hospital treatment, normally to the tune of 80 percent of Medicare-approved costs. For many Medicare Part B enrollees, Medicare supplement insurance helps cover the remaining 20 percent of costs. Part D, meanwhile, refers to Medicare prescription drug plans, which provide important coverage in an area overlooked by Original Medicare Part A and Part B.

The SMI Trust Fund is funded by:

- Medicare Part B premiums

- Medicare Part D premiums

The Part B premium is currently set at $104.90 for most Americans. The vast majority of Medicare recipients are enrolled in Part B and pay the monthly premium. Meanwhile, over half are enrolled in Part D prescription drug plans, often paying a monthly premium ranging from about $20 to $40.

The Supplementary Medical Insurance Trust Fund is also supported by trust fund investments and additional funds authorized by Congress.

Looking ahead …

While the 2013 Medicare Trustees Report (see page 191) shows Medicare has been operating at a deficit from 2009 through the current year, surpluses are projected for the period starting next year and continuing through 2022.

While Medicare expenditures will continue to rise during that period, the Trustees Report paints an optimistic picture with regard to funding. As the report puts it (on page 192):

Under current law, the Trustees estimate that total Medicare income will increase at a significantly faster rate (7.6 percent annually) than expenditures during 2013-2022. This difference arises in part because of the lower expenditures under the Affordable Care Act, the Budget Control Act, and the physician payment reductions. It is also attributable to faster growth in HI payroll tax revenues because the income threshold for application of the additional 0.9-percent tax rate is not indexed for inflation (with the result that an increasing proportion of workers becomes subject to the additional tax rate over time).

That may or may not be overly optimistic given that there are few Medicare promises extending more than a decade into the future. Yet, as the Trustees Report points out (on page 192), “Through most of Medicare’s history, trust fund income has kept pace with increases in expenditures.”

Millions of aging Americans from coast to coast are crossing their fingers and hoping the trust funds will somehow remain solvent for many more years.

Are you optimistic about the future of the Medicare trust funds? Leave a comment below!

Visit this link to find out why the Medicare Population is Growing at a Rate Far Exceeding the General Population.

© 2013 MedicareMall.com