Buying a Medicare Supplement Insurance Plan

10 Things to Know Before Purchasing

It is important to compare Medigap insurance plans and rates to make sure that you find the Supplemental policy that is best for you.

As Medicare Supplement Coverage is standardized in most states and the Medigap coverage is the same from company to company, it is very important to shop around to find the best available Medicare Supplement Rates, Service, and Claims paying ability.

Regardless of the type of Medigap rates the company offers, inflation and changing health care cost will naturally force every Medicare Supplement Insurance Company to adjust rates usually on an annual bases. However, working with an independent Medigap agency keeps you on the leading edge of competition and benefits.

1. What is Medicare Supplement (Medigap) Insurance?

- Medigap Insurance is a private health insurance policy commonly referred to as “Medicare Supplement Insurance.”

- It is designed to pay for the gaps in physician and hospital coverage left by Medicare Part A and Medicare Part B.

Medicare Supplement Insurance Plans can provide you the peace of mind knowing that you will not be burdened by the gaps in health coverage left by Medicare Part A and Medicare Part B.

Medicare Supplement Insurance Plans can provide you the peace of mind knowing that you will not be burdened by the gaps in health coverage left by Medicare Part A and Medicare Part B.

2. What does a Medicare Supplement Policy Cover?

- Medicare Supplement Policies cover medical procedures approved by Medicare at a Medicare Provider.

- Procedures not approved by Medicare are normally not covered by Medicare Supplement Insurance Plans.

3. Who is Eligible for a Medicare Supplement Insurance?

- Anyone who is covered under both Medicare part A and Medicare Part B are eligible for Medigap Coverage.

- Medicare Supplement Insurance Companies reserve the right to set further qualification criteria beyond Medicare Eligibility at their own discretion but can not exclude any person who is in an Open Enrollment or Guaranteed Issue situation.

4. Available Medicare Supplement Plans:

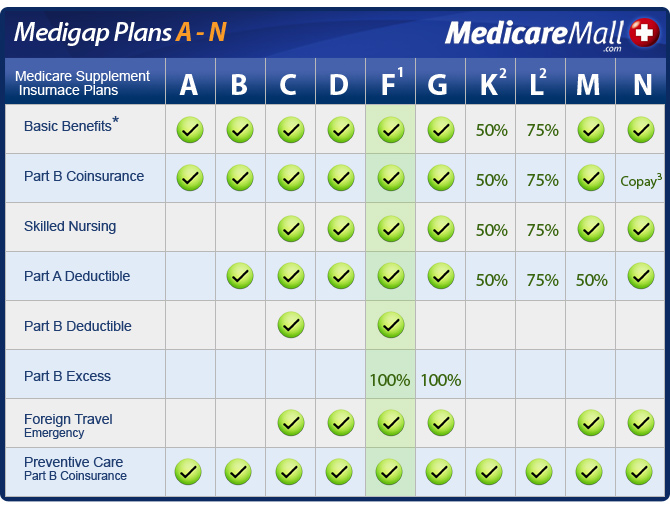

- Most states only allow standardized Medicare Supplement Insurance Plans A-N.

- Any company offering coverage is required to offer the base plan (Medigap Plan A) and any other combination of Medigap plans B-N at their discretion.

5. Plan Differences Between Companies:

- The coverage benefits between Medigap companies for doctor and hospital visits is exactly the same for the same standardized Medicare Supplemental policy.

- For instance, a Medigap Plan F with one insurance company will pay exactly the same as a Medigap plan F with any other company.

- Medigap Companies may choose which standardized Medicare Supplement Policies they wish to offer but all must at least offer Medicare Supplement Plan A.

6. Pre-Existing Conditions:

- Some Medicare Supplement Insurance Companies may have a pre-existing conditions provision that limits their liability on previous medical problems for up to 6 months after the issue date of the Medigap policy.

- Some Medigap companies will not exercise this option.

- If you had “credible coverage” and were covered under an employer sponsored health plan or another Medigap policy the pre-existing condition limitation will not apply.

7. Pricing Differences:

- Medicare Supplement Insurance Plan rates vary from Medigap company to Medigap company, from Supplemental plan to Supplemental plan and from area to area.

- There is no standardization of pricing for Medigap Insurance Plans.

- You could pay substantially more for the exact same coverage if you do not shop around for the best Medigap rate for your particular situation.

8. Choice of Doctors and Hospitals:

- Medicare Supplement Insurance Plans have no limitations on what doctors or hospitals that you go to.

- There are no restrictive networks.

- You simply choose any provider that accepts Medicare, and your Medicare Supplement Insurance Plan will pay that provider as stated in your Medigap policy.

9. Claims:

- Medicare Supplement Insurance Plans have a very easy claims process that are automatically electronically filed..

- For Medicare Part B claims each Medicare Supplement Insurance company is linkeddirectly to Medicare. Medicare will send a copy of the claim and how they paid (known as an Explanation of Benefits or EOB) to your Medicare Supplement provider each time they pay a claim.

- This is the information that the Medigap Insurance Companies use to determine how to pay your Medicare claim.

- Because the claims come directly from Medicare, there is no need for you or your doctor to file a claim for outpatient services.

10. Rate Increases: There are three types of Medigap rates. . .

- Attained age Medigap rates are based on your current age at time of enrollment into the plan, and these rates will be incremented by the year. So the sixty five year old will have a different premium than the sixty six year old and on up the age scale.

- Banded or Issue age Medigap rates is where the Medicare Supplement Insurance Company may chose to offer the same rate for those between certain ages. For example the rate will be the same for those between sixty five and sixty nine, seventy and seventy four, and so forth.

- Community Medigap rates are when the Medicare Supplement Insurance Company offers everyone in the community or state the same Medigap rate for the same Medicare Supplement Plan. In this case the sixty five year old would have the same Medigap premium as the eighty five year old.