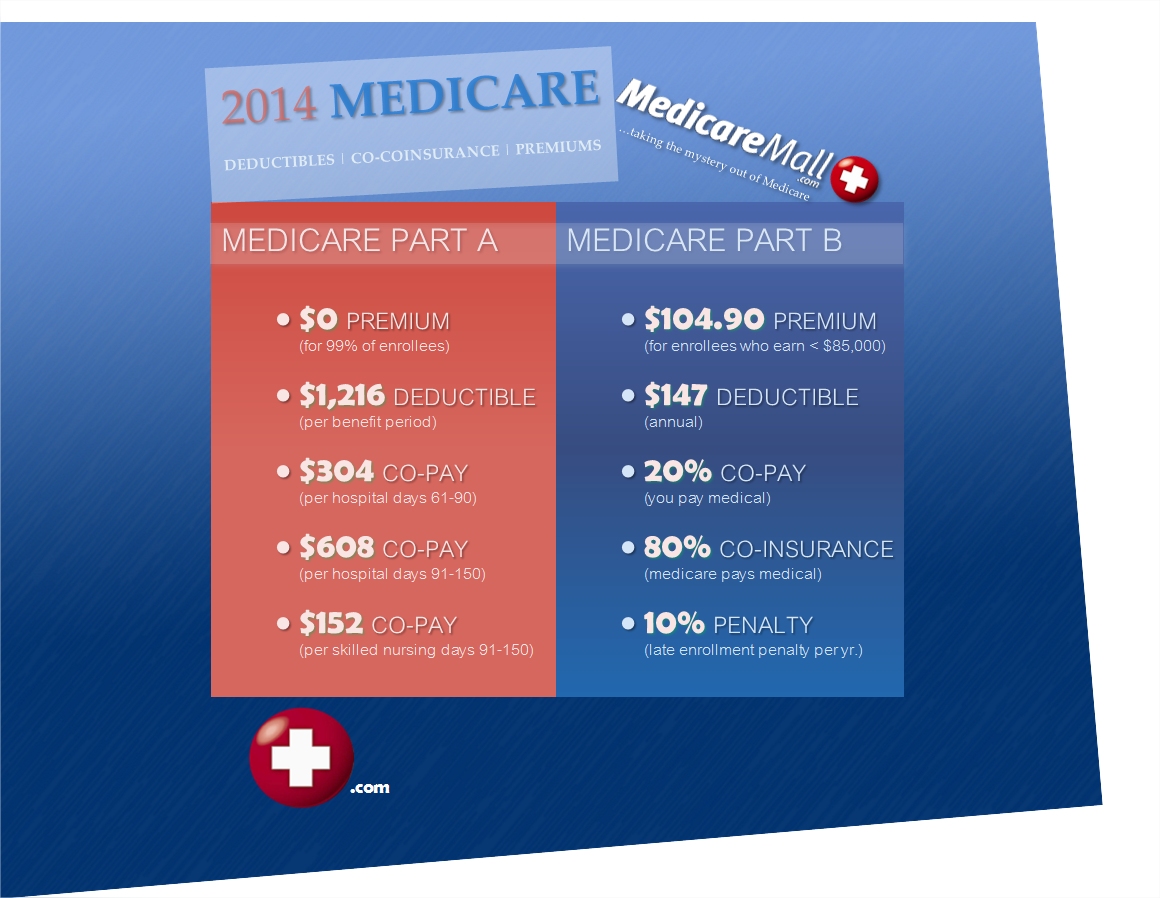

2014 Medicare Part A and Part B Premium and Deductibles

Medicare Part A and Part B changes from 2013 to 2014

You may be aware that premiums and deductibles for both Medicare Part A and Medicare Part B fluctuate from year to year. The Medicare administration has announced Medicare Part A and Part B rates for 2014, with changes taking effect Jan. 1, 2014.

Compare 2014 Medicare Supplement Rates

Medicare Part A in 2014

2014 Medicare Part A Premium:

The Medicare Part A premium, which only about 1 percent of Medicare recipients are required to pay, will be $426, a $15 decrease from the 2013 rate.

2014 Medicare Part A Deductible:

The 2014 Medicare Part A deductible will be $1,216 per benefit period, up from $1,184 per benefit period in 2013.

2014 Medicare Part A Co-payments:

The cost of spending 61-90 days in the hospital will be $304 per day, which is a $7 increase from the 2013 rate. For a hospital stay of 91-150 days, the per-day Medicare Part A co-payment in 2014 is $608, a $16 increase from 2013. After 150 days, Medicare no longer helps pay for hospital expenses.

2014 Medicare Part A Skilled Nursing:

After 20 days in a skilled nursing facility, the per-day Medicare Part A skilled nursing co-payment in 2014 will be $152, or $4 more than in 2013.

Medicare Part B in 2014

2014 Medicare Part B Premium:

The standard 2014 Medicare Part B premium will remain at $104.90 per month, the same rate as in 2013. Higher Part B premium rates for people with higher incomes will also remain at 2013 levels.

2014 Medicare Part B Deductible:

The Medicare Part B 2014 deductible will remain unchanged at $147.

Medigap Protection Against Deductibles, Co-pays, and Coinsurance

Medicare supplement plans go a long way toward helping eliminate Medicare out-of-pocket costs that often go up from one year to the next. An excellent, budget-friendly solution is Medicare Supplement Plan F, which covers all Medicare-approved costs not covered by Medicare Part A and Medicare Part B. With fixed premiums that can easily fit into your budget, Plan F covers all Medicare Part A and Part B deductibles along with “excess charges” you would otherwise have to pay out of pocket. Excess charges are the difference between what Medicare pays and what your medical provider charges—and they can add up fast without the protection Plan F provides! To learn more about how Medicare supplement plans can save you money, request a free Medigap quote from one of our licensed Medicare supplement insurance representatives or call MedicareMall toll-free at (877) 413-1556.

Compare 2014 Medicare Supplement Rates

2014 Medicare Part A and Part B Premium and Deductibles © 2013 MedicareMall.com